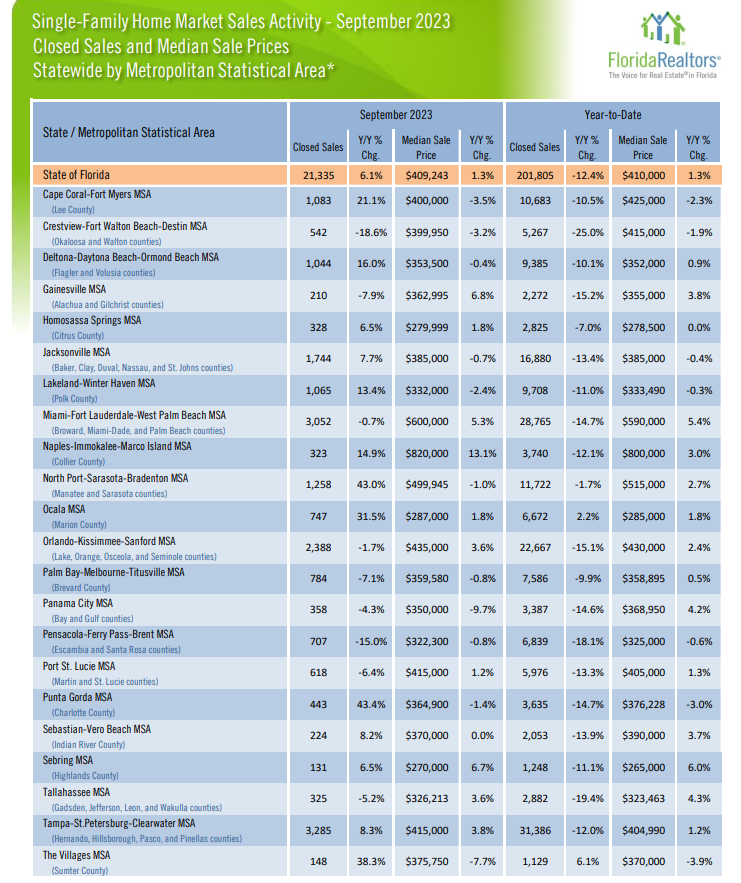

The latest Florida Realtors® report on single-family sales activity for Florida’s 22 Metropolitan Statistical Areas (MSA) shows that 2023 Year-to-Date transactions (Jan. – Sept.) in the Tallahassee MSA are down 19.4% when compared to the same period in 2022.

The data – provided below – reports 2,882 transactions in the Tallahassee MSA in 2023, down from 3,441 transactions in 2022.

In comparison, state transactions are down 12.4%.

During the same time period, the median sales price in the Tallahassee MSA is up 4.3% to $323,463. At the state level, the sales price is up 1,3%, to $410,000.

Not only is home ownership harder to afford now, so is rent. Finding a decent place for less than $2000 per month is very difficult. Meanwhile, incomes remain stagnant. Inflation is everywhere. Will rent come back to more affordable levels?

At these prices and salaries, exactly how does so-called “affordable housing” fit into the equation?

Tallahassee’s economy is different than most of Florida’s. Ours is based on the high number of people employed by State government, 2 universities, TCC, Lively, and let’s not leave out the city of Tallahassee and Leon County.

The price of lumber, drywall, flooring, sinks, toilets, wiring, etc.is national. Just because the truck stops in Tallahassee doesn’t mean materials will magically be 30% cheaper. Folks making $45,000 just can’t afford the price of a starter home no matter who is paying them.

People need to realize that getting a government job isn’t “making it”. Once trained they need to move on to a job that will support them.

August West is spot-on… rinse and repeat, rinse and repeat. Speculation and flippers will once again crash the market and leave millions upside down on their mortgage and in sever debt. A result of a failed education system that focuses on activism, victim hood, and gender studies rather than reading, writing, and arithmetic. Here’s a basic equation that should be easy to figure out…

$15.00 an-hour will not afford you a $400k home mortgage, no matter how many twidiots say it will.

This is just the start. Gird your loins…

All due to Bidenomics worsened by local progressives. For those that vote Democrat what did you think would happen?

I’m SHOCKED that it isn’t down 50% or more.

As soon as the Fed announced they’d be jacking up rates for months and months, I was telling my realtor gfs to get a second job.

Sales will continue to struggle as long as interest rates are so high. P&I on a $100,000 loan is about $450/month at 3.5% on a 30 year loan. That same loan at today’s 8% is about $730. Extrapolate that out to true prices and a $250,000 loan payment was $1125 2.5 years ago. It’s $1800 today. Add taxes and insurance and home ownership for first time buyers is mostly out of their reach today.