Tallahassee Reports’ continuing investigation of a lawn maintenance vendor selected by the City to maintain the various street median’s in the City has found that Southland Specialities provided questionable information on the application for a City business tax certificate.

Previously, Tallahassee Reports found that the store front for the Gold Buyers of Tallahassee, located at 2784-1 Capital Circle NE, was used as the address for another company, Southland Specialties of Tennessee, Inc. to qualify as a local vendor during the City of Tallahassee procurement process.

According to state records, the registered agent and all officers of Southland Specialties of Tennessee reside in St. Augustine, Florida.

Tallahassee Reports recently learned that the City Commission voted to award a two year contract to Southland Specialties of Tennessee for the mowing of City street medians and rights-of-way.

A local small business owner called Tallahassee Reports and complained about an out-of-town vendor mowing City median’s on Southeast Capital Circle.

Research by Tallahassee Reports discovered that on February 13, 2013 the City Commission voted 5-0 to award a 2-year contract to Southland Specialties, Inc. of Tennessee, located in St. Augustine, Florida.

The amount of the contract was not to exceed $566,229.95 in FY2013 for the mowing of City street medians and rights-of-way.

The Local Vendor Preference

Buy local is a popular position for local politicians – and for good reason. Economic studies have found that buying from a local business versus a corporation headquartered out of town has more impact on the local economy.

On November 12, 2012, the City reinstated a local preference policy. The city annually spends significant amounts in purchasing personal property, materials, and contractual services and in constructing improvements to real property or to existing structures.

The dollars used in making those purchases are derived, in large part, from taxes and fees imposed on local businesses; and the city commission has determined that funds generated in the community should, to the extent possible, be placed back into the local economy.

Therefore, the city commission determined that it is in the best interest of the city to give a preference to local businesses in making such purchases whenever the application of such a preference is reasonable in light of the dollar-value of proposals received in relation to such expenditures.

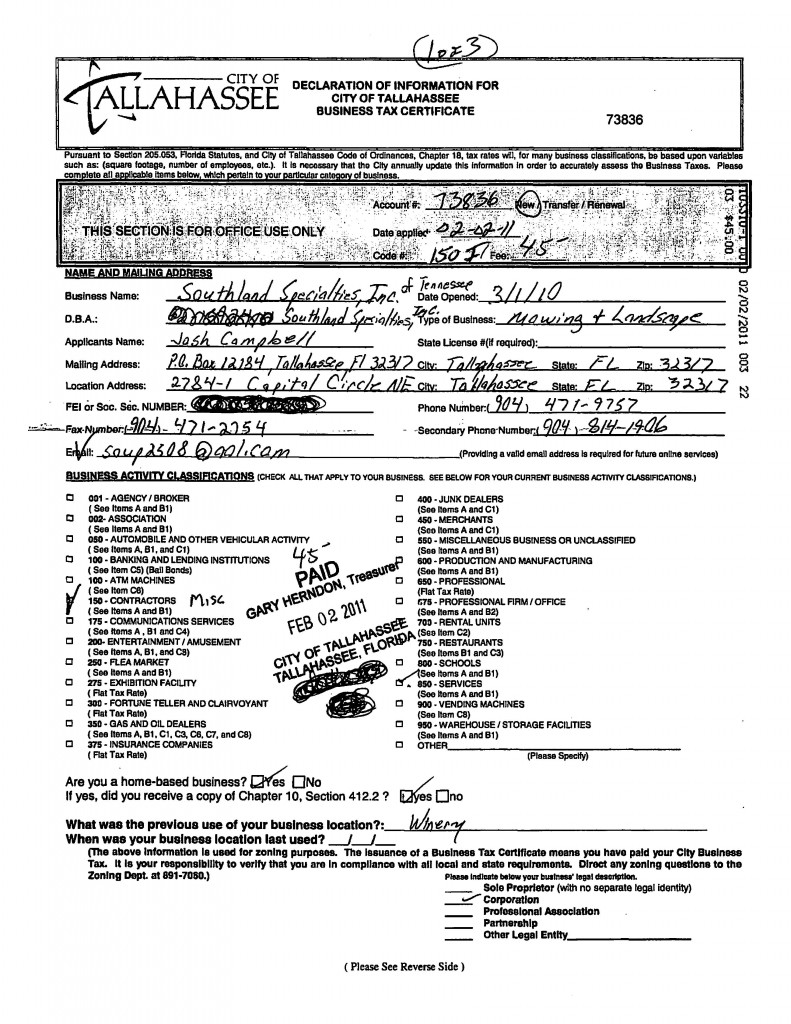

A City of Tallahassee business tax certificate is required to gain local vendor status. The business tax certificate for Southland Specialities is listed at the bottom of this report.

Also, City staff told Tallahassee Reports that they rely on the “honesty” of the vendor when it comes to determining if a vendor receives the local preference designation. In other words, there is not an independent verification that the vendor’s business is actually located at the address submitted by the vendor.

The City Business Tax Certificate

The City business tax certificate for Southland Specialties, provided in a public records request, reveals a number of questionable entries.

First, the location address of the business is given as 2784 Capital Circle Northeast.

However, Tallahassee Reports verified this address is the commercial location for Gold Buyers of Tallahassee.

Also, the form indicates this is a home based business, which is inconsistent with the commercial location provided.

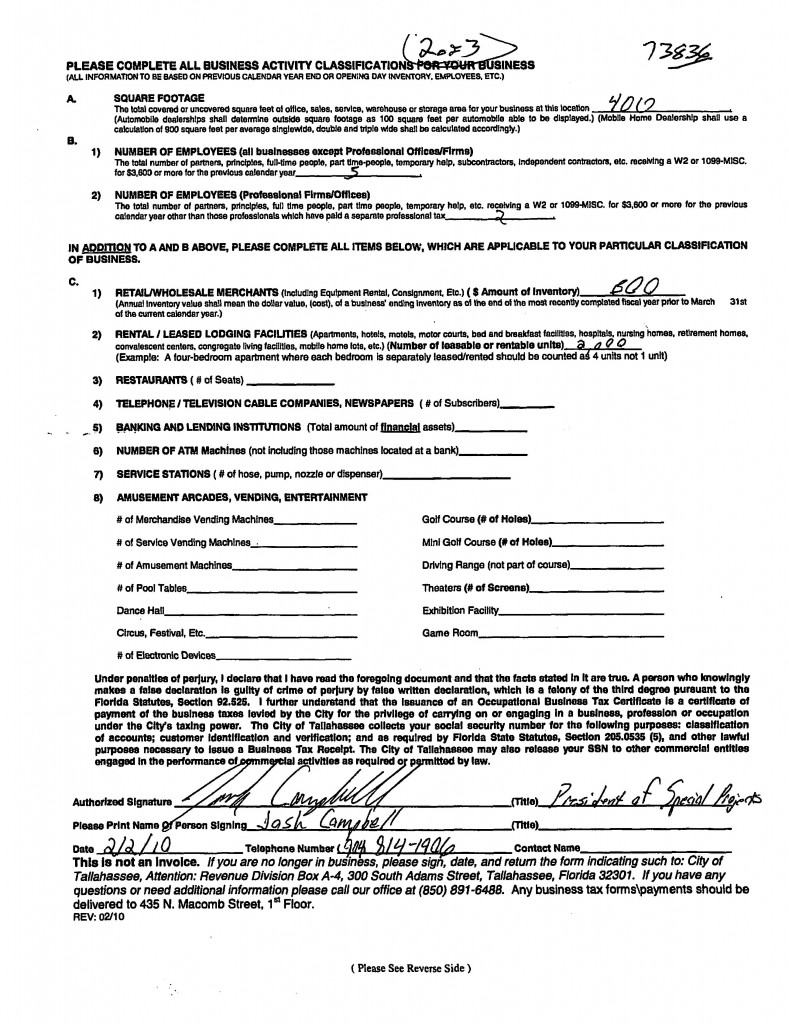

Second, the tax certificate indicates that 400 square feet of the 2784 Capital Circle is used for Southland Specialties.

However, a visit to the location and a discussion with an employee of Gold Buyers indicated that only a small office space was designated for Southland Specialties.

Property records indicate the total office space for the 2784 address is 1485 square feet.The portion being used by Southland Specialties was estimated to be less than 100 square feet.

Also, the attendant stated that no lawn mowing equipment was stored at that location. Instead, the attendant indicated that the “company” rents a home in Tallahassee and stores the equipment at that location for the employees that travel into town and work from Sunday to Friday mowing the medians.

The business tax certificate requires a signature and clearly states that “Under penalties of perjury, I declare that I have read the foregoing document and that the facts stated in it are true. A person who knowingly makes a false declaration is guilty of crime of perjury by false written declaration, which is a felony of the third degree pursuant to the Florida Statutes, Section 92.525.”

While the local vendor preference was not the deciding factor in awarding the bid in this case, legal analysts tell Tallahassee Reports that falsifying the local vendor affidavit could result in severe penalties.

Tallahassee Reports will continue to investigate.

While looking into this one how about looking at:

Imported pine bark mulch as opposed to locally produced waste-wood mulch.

Locally produced landscape plants as opposed to out-of-town trees and shrubs.

Use of out-of-town tree services as opposed to use of local tree services.

Trust, but verify. In order to get “local” points awarded in a bid contract, the business should be paying local property tax either on a home, commercial building, or land. That way the vendor has a vested interest in this community or the surrounding areas. It is unfair to have businesses in this community paying local property taxes and local electrical rates, but being shut out of local government jobs because their overhead is too high. Gee whiz, even the school district requires 2 proofs of residency.

It is incumbent on the city to investigate the local vendor claim of Southland. If a false bid was submitted the city should revisit the contract for possible cancellation and initiation of a rebid process.

The city commission should also review the bid procedure that allows such abuses, to the detriment of local business owners.