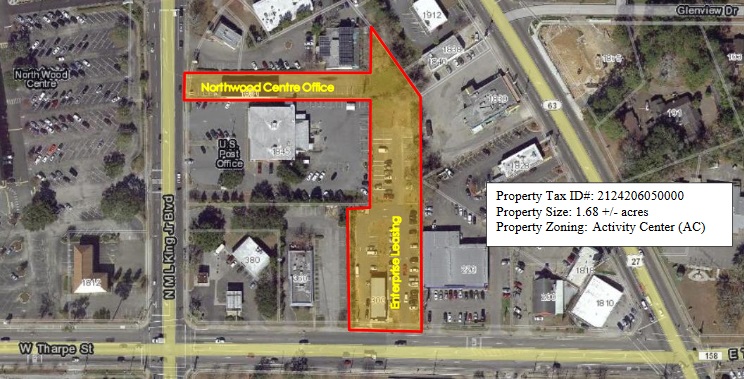

On Wednesday the Tallahassee City Commission will consider releasing an Invitation for Bids (IFB) for the sale of the Northwood/Enterprise parcel (1.68 +/- acres). The parcel, which was acquired in May of 2019 as part of the Northwood Centre purchase, was appraised in October of 2019 for $525,000.

The property has frontage on both N. Martin Luther King, Jr. Boulevard and W. Tharpe Street. A 1.33-acre portion of the property is under a ground lease to Enterprise Leasing for $12,240 per year. Enterprise Leasing has options to continue the ground lease until 2034 with 2% increases in rent every two years. In addition, Enterprise Leasing has a right of first refusal of any offer to purchase all or any part of the Northwood/Enterprise parcel during the term of its lease.

Support Local Journalism by Signing Up

for a $50 TR Annual Subscription

The remaining 0.35 acres is improved with a 2,407 square-foot office building that is not currently occupied.

According to city documents, the property is in the Activity Center (AC) zoning district, within the Multi-Modal Transportation District (MMTD) and could be developed independently or assembled with adjacent parcels.

City staff anticipates prospective demand will be from adjacent property owners. The AC zone allows a broad range of uses, including types of residential, community services, retail, office, restaurant, recreation, cultural venues, and services.

Was the appraisal of $525,000 performed internally for the purpose of accessing property taxes or externally by certified appraiser to determine market value?

“The AC zone allows a broad range of uses, including types of residential, community services, retail, office, restaurant, recreation, cultural venues, and services.” *************** Hmmm, at 1.68 Acres, a Developer could build 14 Single Family Homes…………LOL.

Wasn’t one the options for this property low cost housing?

too

The city and the county really need to get out of the real estate business. It is not a function of government services. There is roo much property off of the tax rolls.

“was appraised in October of 2019 for $525,000. ” …………………Keep in mind that it is APPRAISED at $525,000 so, it’s actually worth more. My House is worth about $125,000 but is Appraised for about $80,000 which is a lot LESS than what it is actually worth.

Depends on the appraisal. The appraised value(for taxes) is limited. It can only go up by a certain amount even if the value increases by a large amount. This creates an appraised value(by the county appraiser) that is well below the market value.

The ‘assessed’ value (not appraised value) can only go up no more than 3% or the CPI, whichever is less. (As I understand SOH)

Only applies to personal residence homestead not commercial property