According to Leon County Clerk of Courts data, the number of mortgage foreclosure cases are trending up. This trend is consistent with the direction at the national level.

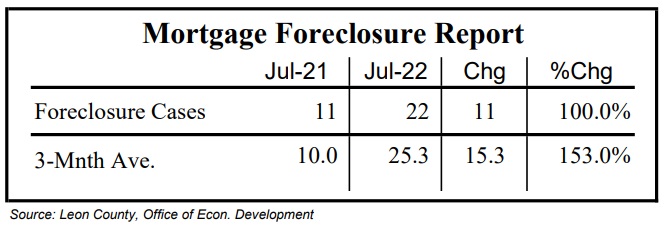

The Mortgage Foreclosure Report, provided below, shows the number of foreclosure cases doubled in July when compared to the number of cases recorded one year ago. There were 22 cases in July 2022 and 11 cases filed one year ago.

A look at the 3-Mnth Ave. data – which smooths out the month to month volatility – shows a 153.7% increase in the number of foreclosure cases from one year ago.

These numbers are remarkable consistent with the findings of a national real estate data company.

ATTOM, a leading curator of real estate data nationwide recently released its Midyear 2022 U.S. Foreclosure Market Report, which shows there was a 153% increase in foreclosure filings — default notices, scheduled auctions or bank repossessions — in the first six months of 2022 when compared to the first six months of 2021.

For Leon County, filings show that there was a 141% increase in foreclosure filings in the first six months of 2022 when compared to the same period in 2021.

“Foreclosure activity across the United States continued its slow, steady climb back to pre-pandemic levels in the first half of 2022,” said Rick Sharga, executive vice president of market intelligence at ATTOM. “While overall foreclosure activity is still running significantly below historic averages, the dramatic increase in foreclosure starts suggests that we may be back to normal levels by sometime in early 2023.”

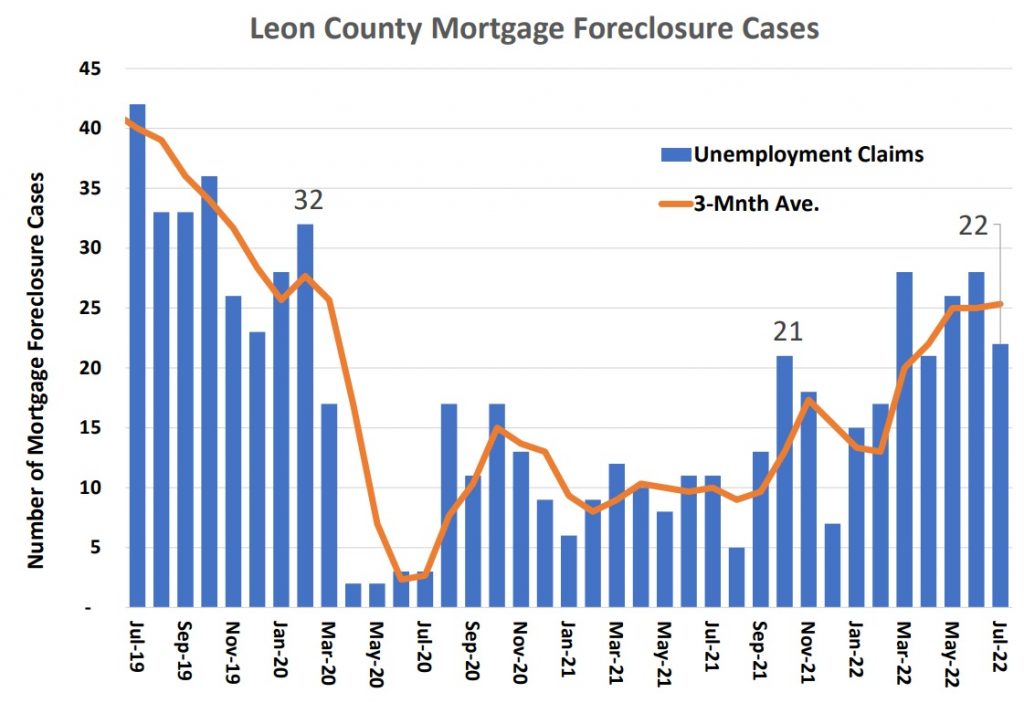

Looking at the level of foreclosure filings in the months before the impact of the pandemic (March 2020), “normal levels” for Leon County would appear to be between 30-40 foreclosures per month.

“It’s important to note that many of the foreclosure starts we’re seeing today – in fact, much of the overall foreclosure activity we’re seeing right now – is on loans that were either already in foreclosure or were more than 120 days delinquent prior to the pandemic,” Sharga added. “Many of these loans were protected by the government’s foreclosure moratorium, or they would have already been foreclosed on two years ago. There’s very little delinquency or default activity that’s truly new in the numbers we’re tracking.”

The chart below shows the number of mortgage foreclosure filings reported each month since July, 2019. A 3-Mnth Ave. line is also included.

It important to note there was a statewide suspension of mortgage foreclosures by executive order from April 1 through September 1, 2020.

““It’s important to note that many of the foreclosure starts we’re seeing today – in fact, much of the overall foreclosure activity we’re seeing right now – is on loans that were either already in foreclosure or were more than 120 days delinquent prior to the pandemic,” Sharga added. “Many of these loans were protected by the government’s foreclosure moratorium, or they would have already been foreclosed on two years ago. ” [from the post]

Let me guess, Biden is responsible for foreclosures that would have occurred on Trumps watch? Time Travelling Dark Brandon is more powerful than I was led to believe.

Glad to see that Nikki got her clocked cleaned by Christ. Had Nikki won, I think she may have played the “gender card” and convinced a lot of White suburban housewives that “Isn’t it time for a woman in the Governor’s Mansion?” Who knows, she may have been able to pull it off for a win.

Now, with DeSantis up against Christ, the contest is like young Rambo against an aged Arnold Schwarzenegger. My money is on the young guy.

@Pat.

Well, if I had the correct Democrat tools I would have watched you smile as you typed that.

(Nice shirt, by the way.) 😉 😉 😉

@ A Skeptic I was teasing about Fried. I vote straight Republican. The margin of victory would be larger with Fried being the candidate. I was trying to be funny.

@Pat,

I don’t believe that Charlie or Nikki can beat DeSantis (thankfully), but I pulled for Nikki, too. Charlie’s a chameleon that’s spent his life living off the taxpayers and seems to be looking for one more big payday before retiring.

Nikke putting him out to pasture now would have been nice, but it appears we’ll have to listen to him for a few more months now….

Where is my checkbook?

Tomorrow we get to pay off a bunch of student loans.

Let’s Go Brandon.

Come on Nikki.

I used to live in Huntington woods. After being there several years, a “spec” house was built across the street from me. The most interested buyer was a minority family that didn’t qualify. Instead of moving on, they got the NAACP to represent them in “negotiations” with the bank. The bank relented and loaned the buyer’s the money.

As expected from their initial non-qualification, they couldn’t afford the house. A dead station wagon was parked in the yard and the weeds later grew so tall that the vehicle could not be seen. They never acquired a lawn mower. The city would occasionally make a couple of passes near the curb with their highway mowers when things got too out of hand.

Eventually, the house was foreclosed and 10s of thousands were spent to make it saleable.

This is a foreclosure that should never have happened but throwing money on the floor and set fire to it seemed like a better option to the lender than a public fight with the NAACP.

I now wonder how many foreclosures are political? Where the mortgages shouldn’t have happened but outside factors forced the bank to make a bad loan.

@Hope…not before I read your comments. I’m not sure why TR is acting like Twitter and Facebook.

My comment was censored.

TR: it would be interesting to see how many foreclosed homes had a loan, also, with the County’s national controversial PACE program.

An inquiry of the county a few months ago found that the PACE entity the county signed an agreement with to solicit citizens (nationally aged, low income, disadvantaged typically) had GONE OUT of BUSINESS!

It would also be interesting to see how many went into bankruptcy and foreclosure, pre-pandemic.

Note: their loans do not go through the normal scrutiny to see if the homeowner can actually PAY the loan payment!

This program should be discontinued immediately.

Maybe the owners couldn’t keep up with the skyrocketing home insurance rates. No worries, as long as major corporate profits have soared. Plus, the more foreclosures, the more foreign owners will buy up properties the properties and charge exorbitant rents. So glad the economic woes here benefit the foreign investors and developers like the clearcutting Ghazvinis and Boulos.

@David

All of the reasons you listed.

Don’t worry… the current Resident will soon propose that we taxpayers pick up the tab for their bad decisions. The Resident will soon propose that we taxpayers pick up the tab for at least $10k (per student) in student loan debt. Turns out that there isn’t much of a hiring demand for a person with a degree in Urinal Use by One-legged Lesbian Trans Studies.

It’s a shame that anyone loses their Home. I always wonder why, did they lose their Job, did they buy too big of a House, did they try to keep up with the Jones’s and it finally caught up to them, did they just walk away because they were upside down (even though they could still make payments)? When the housing bubble burst last time, a lot of people were to to just walk away even though they could still make the Payments.

@Pat — both parties do their best to turn voters in their direction.

Republicans make jobs, fill them, promote real wage growth, and put people in charge of their own lives.

Democrats suppress wages, make life tough, and have more people relying on government handouts.

Try as the Democrats might, they can’t change the objective reality of how badly Joe Biden’s economy is affecting the American public.

The percentage of Americans who evaluate their lives poorly enough to be considered “suffering” on Gallup’s Life Evaluation Index was 5.6% in July, the highest since the index’s inception in 2008.

This was no accident or coincidence. Biden and his minions took steps to cause inflation. And our local governments are on board with Biden. Just look at the push to change to electric city buses and forcing new construction homes to install EV charging ports.

A Recession is when your neighbor loses his home.

A Depression is when you lose your home.

A Recovery is when Biden is voted out of office and Trump is President.