By Jim Turner, The News Service of Florida

TALLAHASSEE — State regulators Friday asked a judge to place a property-insurance company in receivership, making it the sixth Florida property insurer declared insolvent this year amid widespread financial problems in the industry.

The Florida Department of Financial Services sought to be appointed receiver for FedNat Insurance Co., which canceled 56,500 policies in May and reached an agreement to transfer about 83,000 policies to another company in June.

Despite shedding the policies, FedNat remained responsible for claims and other types of obligations from before June 1, according to court documents. It notified the state Office of Insurance Regulation on Sept. 13 that it did not have enough money for what is known in the insurance industry as a “runoff” of the obligations.

“Respondent (FedNat) notified OIR that it had overstated its cash position and could not complete a solvent runoff,” said the court petition, filed by the Department of Financial Services’ Division of Rehabilitation and Liquidation. “OIR immediately sent an examiner to the company. On September 14, 2022, Respondent advised OIR that it did not have sufficient cash on hand to pay its obligations and debts as they come due in the normal course of business. Therefore, Respondent is insolvent as defined (by a section of state law) and delinquency proceedings are appropriate.”

Insurance Commissioner David Altmaier sent a letter Wednesday to state Chief Financial Officer Jimmy Patronis, who oversees the Department of Financial Services, that ultimately triggered the court petition Friday.

The filing was another sign of trouble in Florida’s property-insurance system. Other insurers declared insolvent since February were Southern Fidelity Insurance Co., Weston Property and Casualty Insurance Co.; Lighthouse Property Insurance Corp., Avatar Property & Casualty Insurance Co. and St. Johns Insurance Co.

Those insolvencies have contributed to massive growth in the number of customers pouring into the state-backed Citizens Property Insurance Corp., which was created as an insurer of last resort. As of Sept. 16, Citizens had 1.055 million policies, more than double the number from two years earlier.

A document presented to the Citizens Board of Governors last week said Citizens had received 19,740 customers who previously had been insured by FedNat. The document did not provide details about those policies, but the Office of Insurance Regulation in May issued an order that included what one regulator described as an “extraordinary remedy” of the early cancellation of 56,500 FedNat policies.

Before that order, FedNat had about 140,000 policies, the regulator, Virginia Christy, said in an affidavit attached to Friday’s court filing. Along with the cancellations, FedNat agreed to transfer the roughly 83,000 remaining policies to a related company, Monarch National Insurance Co., with the condition that Monarch would not be responsible for obligations from before June 1.

Court documents indicate that the Office of Insurance Regulation has been concerned about FedNat’s finances since at least March 2020, when the state started requiring the company to file monthly financial statements. Later in 2020, regulators started holding frequent conference calls with company officials about its financial status.

“Despite capital infusions, Respondent’s (financial) surplus continued to decline, and its underwriting losses continued to increase throughout the remainder of 2020 and into and throughout 2021,” the court petition said.

Along with canceling policies and agreeing to transfer the remaining policies to Monarch, the Sunrise-based FedNat this year also stopped writing new policies, the petition said. It also lost its financial rating Aug. 1 from the ratings agency Demotech.

When property insurers become insolvent, the non-profit Florida Insurance Guaranty Association typically steps in to pay claims. Known as FIGA, the organization has authority to levy “assessments,” which are costs passed on to insurance policyholders across the state.

FIGA already is using money from assessments of 1.3 percent and 0.7 percent to pay costs related to other insolvencies. Its board last month approved a plan to borrow $150 million, with the debt financed by extending the 0.7 percent assessment through 2023.

Hold on and wait for your renewal policy to double this year as mine did before hurricane Ian. I refuse to pay $7,500 a year to insure.

This is going to cause a huge increase in payments for those who have escrow accounts. This will impact the foreclosure filings as people cannot afford the higher costs. Top that off with an ARM loan where your interest rate increases.

The solution is to build wiser. First floors of homes must be higher above sea level and homes need to be built to withstand 200 mph winds. If we don’t do this, government will force insurers to charge everyone else higher rates to insure people living where big storms are inevitable.

If the government doesn’t stop the geoengineering, nobody will be able to by any kind of insurance ever again.

I think that as time goes on, we will all find out that insurance companies and banks are so tightly interwoven that both will leave their depositors high and dry in a domino effect that will leave depositors impoverished after their life savings are absconded with in the Ponzi scheme known as the stock market.

For decades now, insurance companies have called themselves banks when conditions were favorable and they have called themselves insurance companies when conditions favored being an insurance company.

Either way, whether you want to call yourself a depositor or an insured party, you are hosed.

How ’bout any insurance companies owned by Warren Buffoon? If he got any in Florida he’s toast.

The solution to this dilemma is really quite simple.

1. Before being awarded an insurance license to operate, a company must post a bond guaranteeing at least 75% of their tangible and liquid assets.

2. Any company that is declared insolvent must surrender – or have seized – all company and board member personal assets to help cover their customers losses.

3. Any company that cancels policies or seeks to pull out of Florida, must repay all paid premiums – with interest – to any customer that hasn’t made a claim… or have their bond and/or company and board member personal assets seized and distributed to their customer accordingly.

I tried to shop a homeowners policy a couple of months back and the lowest premium we could find was nearly triple my existing policy. (I’ve got a nearly 40 year history of continue insurance with no claims.)

I also had a policy on a rental cancelled and am struggling to find anyone to write a new policy.

It’s a miserable insurance market out there right now….

“Other insurers declared insolvent since February were Southern Fidelity Insurance Co., Weston Property and Casualty Insurance Co.; Lighthouse Property Insurance Corp., Avatar Property & Casualty Insurance Co. and St. Johns Insurance Co”

In addition to these companies and FedNet, who the heck are these companies? Can just anybody open an office and say they are an insurance company? Is this a get rich ponzi scheme ending always in bankruptcy while invrstors make millions?

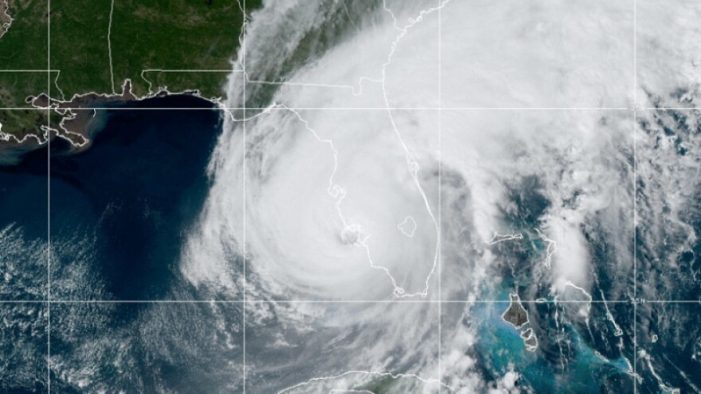

Hurricane Ian probably just forced some other companies into insolvency or, at least, to no longer do business in Florida.

Good to know some political leaders seem more concerned about folks in Texas getting a flight to Mass. to be taken care of than folks living in Florida being able to obtain home insurance at a reasonable cost and with a non-government affiliated insurance company.

What top insurance executives receive in yearly compensation and what those companies expend annuallybon lobbying is absurd.