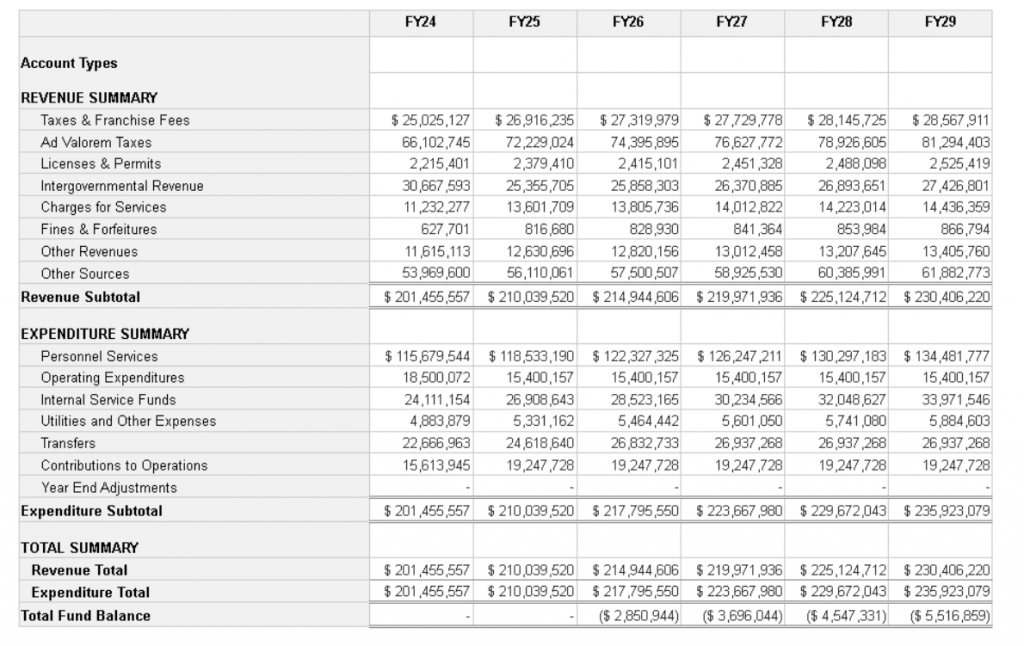

During the last city of Tallahassee budget workshop, the city staff provided an update to the projected FY2025 revenues and expenses.

For the general fund – which is mostly funded by property taxes, charges, and fees – the revenue is projected to increase from $201 million in FY2024 to $210 million in FY 2025, a 4.2% increase.

Based on the current city staff proposal, expenses are projected to match the revenues at $210 million.

Due to increasing property values, property tax revenue – without a millage rate increase – will increase 9.2%, from $66.1 million in FY24 to $72.3 in FY 25.

Where is the increase in property tax revenues being allocated?

Tallahassee Reports analyzed the projected budget and discovered significant increase in four categories. These “significant increases” are characterized by double digit increases over FY 2024 levels and/or are not consistent with expenditures in pervious years.

Star Metro

The budget update indicates that StarMetro, the city’s bus system, is struggling financially and has not reached pre-COVID passenger levels. This situation is costing taxpayers. The budget calls for a 40% or $2.2 million increase in the general fund subsidy to StarMetro. The FY25 StarMetro subsidy is $7.2 million. Just two years ago, the StarMetro subsidy was $3.8 million.

The Capital Fund

Each year, the Five-Year Capital Improvement Plan (CIP) is updated to include the new fifth year for recurring and new projects in each Fund. Updating the CIP is part of a continuous planning, design, implementation, and construction cycle.

The FY25 transfer to the capital fund increased $1.9 million or 44.2% to $6.2 million from $4.3 million in FY24. The capital fund transfer was $3.8 million in FY23 and $4.3 million in FY22.

Vehicle Garage Expense & Reserves

The budget update indicates that vehicle garages expenses increased $1.2 million or 50% over the FY24 level of $2.4 million to $3.6 million. During FY23 & FY22 the vehicle garage expense was $2.4 million.

The projected FY25 budget calls for $1 million transfer to the reserve fund. This is the same as in FY24, however the transfer to the reserve fund in FY22 & FY23 was zero.

The next city meeting related to the budget will be on September 11th, 2024.

General Fund Budget, FY24-FY29

Only pay for public transportation based on documented rider usage! Why does the City continue to waste tax dollars when the need is obviously not there!!!

We need a Republican budget czar! We’ve got Dems and Progressives running this town with the developers calling the shots and filling the Dems coffers! Does every fulltime City employee receive a 5% raise? Of course the senior staff exceeds that. Turning into Cali! Soon you won’t be able to pay retirement!

The commissars are hitting up the northside’s property taxes to pay for the failing Star Metro, which primarily serves the southside?

Yet another good reason to support deannexation.

The Vehicle Garage Expense, is that as in “Vehicle Repairs”? If so, A solution to lower that cost would be to have your own Motor Pool like the State used to have. My first State Job was at the DMS Motor Pool. We had 5 Mechanics, 1 Oil Changer/Tire Repair Guy and two Auto Detailers and our own Gas Pumps. Jeb Bush got rid of it and the Auto Repair Cost sky rocketed.

would like to see a breakdown of the tax increase money going all to public safety. Looking at it as a former budget analyst it seems to all just go into general revenue wherever Reese Goad wants to earmark it.