Based on market conditions as of January 1, 2024, Leon County property owners will pay approximately $40 million more in property taxes to seven different taxing authorities in FY2025 when compared to FY 2024.

The tax increase is due to the increase in taxable property values in Leon County which increased approximately 10% from 2023 to 2024, with overall market values reflecting an increase of over 7.3%.

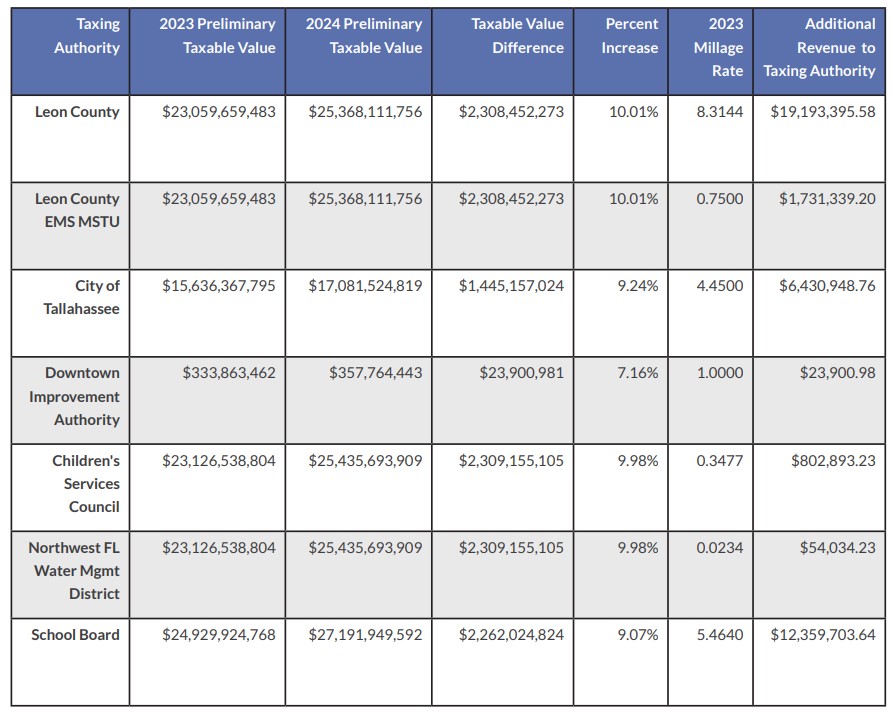

The table below – provided by the Leon County Property Appraiser’s Office – shows that Leon County Government will receive an additional $19 million in tax revenue, followed by the School Board which will receive $12.4 million.

COMPARISON of 2023 & 2024 PRELIMINARY TAXABLE PROPERY VALUES

Thomas County has a Population of just 45,561 People and their Tax Millage Rate is 6.420 for the Incorporated area and 4.830 for the Unincorporated area.

Raise property taxes, vote your county commissioner out. Instead of giving targets, walmarts, amazon big property tax decreases and sales tax loopholes, lower the tax rate and more people will move here. We dudnt elect commissioners to become bankers and developers!

Meanwhile, Thomas County has reduced their tax rate for the 11th straight year in a row:

https://www.wtxl.com/news/local-news/thomas-county-lowers-property-taxes-for-11th-year-straight#

Thomas County is a Republican county.

How many years in a row has Leon County raised their property taxes?

It is more effective to express to our elected officials that we expect them to reduce the millage rate so they collect only the additional amount needed to offsetting inflation and/or for specific projects that are supported by the community. That is what our county and city officials are supposed to do. Just because government can collect more, doesn’t mean it HAS to collect more.

It would be nice if you had included the 2024 tax rate along side the 2023 so we could see who is rolling back, doing continuation and raising the rate.

Tax, tax and tax until residents realize other cities/states offer the same benefits for less money.

This is what I have been saying for Years. Do NOT raise the Property because Home Values are going up and we have been having a LOT of Subdivisions going in all over with Homes starting in the $300 Thousands, so just wait for them to get built and sold. There is one of about 500 Homes going in at Hwy 27S and April Rd., one of about 900 Home going in at Blairstone & Paul Russell, one of about 700 Homes going in at Woodville and Capital Circle, One of about 300 Homes going in at Merchants Row and Blairstone plus all the Homes being built in Southwood, out Thomasville Road and out Mahan Dr. A few Thousand Homes at least to be Taxed in a couple Years all selling for over $250,000 each. I bet you can lower the Mileage Rate down to 6.0 and still raise enough money.

It’s kind of a double whammy. Property values go up across the board, increasing the local government’s tax revenue by millions. But that’s not enough of our money for them to spend in a way that makes them happy so there are rate increases to go along with it.

When is enough enough?