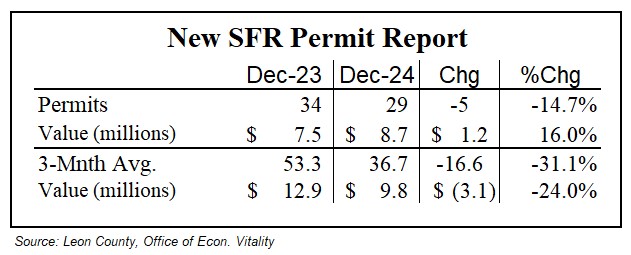

According to filings with Leon County and the City of Tallahassee, the number of single-family new construction permits were down 14.7% in December 2024 when compared to December 2023.

There were 29 permits issued in December 2024, down five from the 34 permits issued one year ago. There were 33 permits issued last month.

The value of the December 2024 permits was $8.7 million, up 16.0% from the $7.5 million reported in December 2024.

The 3-Mnth Avg. data (Oct-Dec) – which smooths out the month-to-month volatility – shows a 31.1% decrease in the number of permits issued over the same 3-month period one year ago.

The 3-Mnth Avg. data show a 24.0% decrease in monthly average permit value during this period. The 3-month average permit values fell from $12.9 million in December 2023 to $9.8 million in December 2024.

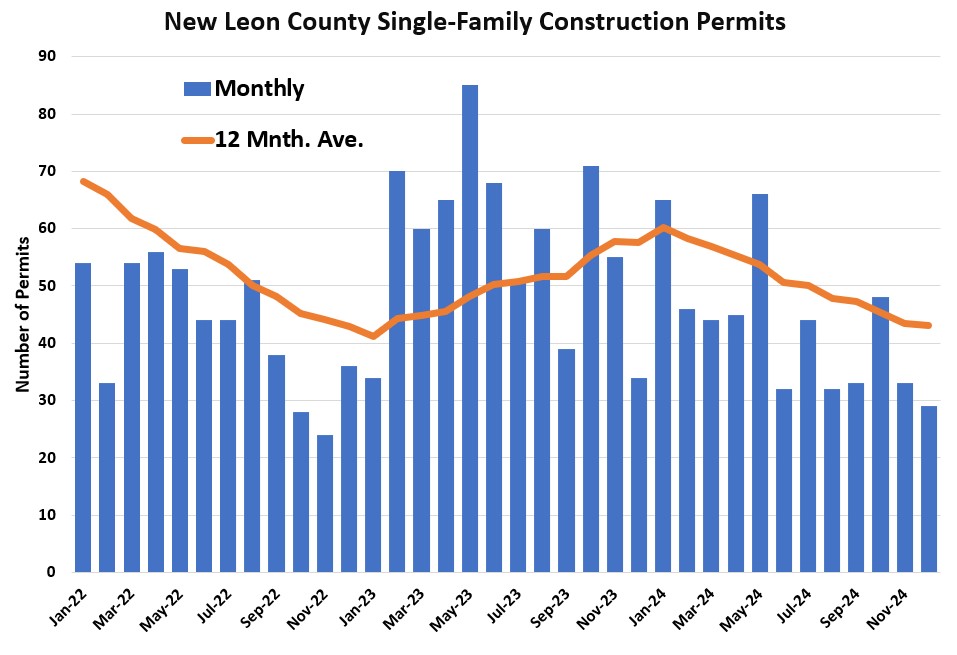

The chart below shows the number of permits issued each month for the last 36-month period. A 12-Mnth Avg. line is also included.

@ DeadToRights = When I was Younger, I had 2 to 3 Room Mates to split the Costs of Renting. I see a lot of 30’s and 40’s Year Old’s doing that now so they can save up to buy their own Home. They would Rent a 4 or 5 Bedroom Home and who ever got the Master had to pay extra but it works. Think about it. I knew 3 Couples that Rented a House together for 4 Years and before they knew it, they all saved enough money to Pay Cash for their Homes.

As a young man, the idea of owning my own home at this point seems like a far off fantasy. The value of the dollar has fallen so low, the cost of homes so high, that I view it as a real possibility I will be forced to rent for the rest of my life. That comes with the added bonus that, if I’m ever injured or forced out of work, I’ll lose my rental and end up on the streets. I’ve watched for years as every home my family and extended family has owned has fallen to foreclosures, reverse mortgages or eviction because of rent hikes. There cannot possibly be a good outcome if this continues any longer.

There are only so many People who can afford Homes selling for $300K and UP and my guess is, most of them already bought one. Plus the HIGH Interest Rates are stopping many Buyers because the High Rates ads $100’s to your Payments. At these Rates, you are almost Tripling the price of the House when it it finally paid off.

Unsurprising. No one can afford to buy a house any more. Maybe in a year or two this will change.