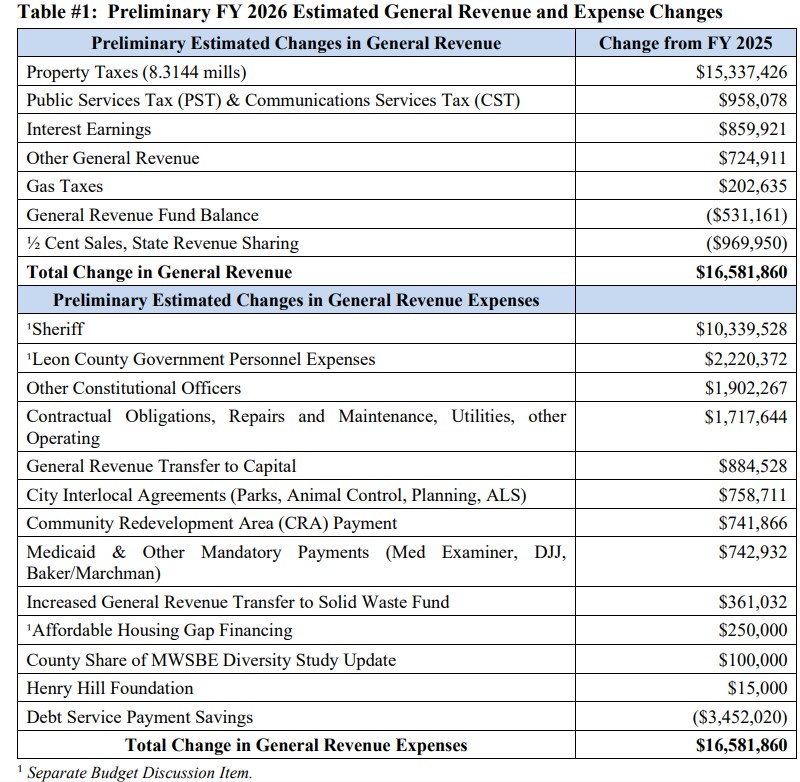

Provided below is a table detailing the source of new revenue and new expenses related to the Leon County Government FY 2026 budget.

The table shows the source for $16. 5 million in new general revenues and the preliminary estimated changes in general expenses.

The majority of new revenue – $15.3 million – come from property taxes due to the increase in property values. There is no increase in the millage rate.

Approximately 60% of the new revenue is allocated to the Leon County Sheriff’s Office.

The extra money going to LCSO should be closely reviewed. The reason correctional deputies are working 2-5 mandatory days a month and their lives at risk is that this administration has and has had for some time over 40 funded correctional deputy positions open. They do not recruit as hard as they could, and turnover rates are high. Morale is low. This is over $3,000,000 in funding for this year not used for what it’s meant for. I’m sure it’s been reallocated somewhere else for salaries, programs, or EVs for all of command staff. Including a couple very nice EV trucks. Not sure why an Assistant Sheriff would need one of these? Command Staff under this administration is four times larger than any other administration. Bigger than a lot of larger metropolitan agencies. At the same time, the size of a patrol shift has only increaed by 1-2 deputies. And often times a patrol shift is lucky to have 12-13 deputies covering the county. And before approving another deputy for the homeless unit, can someone present facts, figures, or information they are truly making an impact?

“$15.3 million – come from property taxes due to the increase in property values.”

I’m thinking it is mainly from all the new $250,000 and UP priced Homes being built over the past few Years that is bringing in all the new Revenue. There are still Hundreds being built and many Hundreds about to be built soon which is why you do not need to be raising ANY Taxes or Fee’s, just sit back and wait for the Money to roll in.

When the county leaves the millage rate the same and property values go up, the county has indeed raised property taxes.