TR recently published a report on the proposed increase to the fire service fee. The full report can be read here.

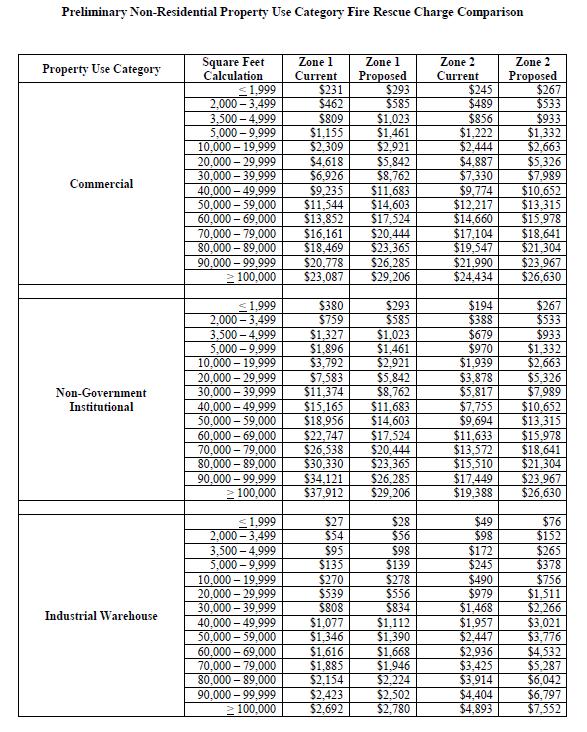

Listed below is a schedule for the proposed increase for the business classifications for all businesses located within the City limits and Leon County.

To look up the proposed fee you need to know the square footage of the office and if the office is located in Zone 1 or Zone 2. Zone 1 applies if the business is located within 5 miles of two core fire stations. Zone 2 applies if the business is located more than 5 miles from two core fire stations.

For example, from the chart below, if the size of office is 3600 square feet and is located in Zone 1, the current annual fee of $809 is slated to increase to $1023, or approximately 26%.

These rates are proposed and have yet to be voted on by the City and County.

Don’t get me wrong, I absolutely oppose a fire service fee.

Property taxes should cover the cost of adequate protection by the governing body.

Great points, but this one above is the key point.

Both entities, the County and City, use fees to provide core services to avoid engaging in a true budget discussion/debate. Citizens should demand, by referendum if needed, that emergency services be provided out of property taxes. Then, there can be transparent discussion of the other “priorities”. My hunch is that if given a choice, many taxpayers would not support many of the projects elected officials choose to fund with tax money. Remember, every dollar taken by government is a dollar not flowing out of your pocket as you see fit.

Amazing that businesses are being punished because the city/county hasn’t kept up with providing adequate protection given the expansion in Leon County.

Why would there be ANY location not within 5 miles of two core stations? That is the fault of the planners, not the businesses…

If anything, the cost should be less for those since they are not being serviced to the same level as those within 5 miles of two stations.

How much property if off the tax rolls? It has been awhile since I looked but there were a shocking number of parcels owned by various governments that seemed to have nothing to do with running the government. How much would Selling unneeded properties increase our property tax income? Hmmmm?