The recent debate over the proposed 23% property tax increase has overshadowed another double digit increase due to go into effect on October 1.

The proposed property tax increase, if adopted, will bring in an additional $8 million annually, beginning October 1.

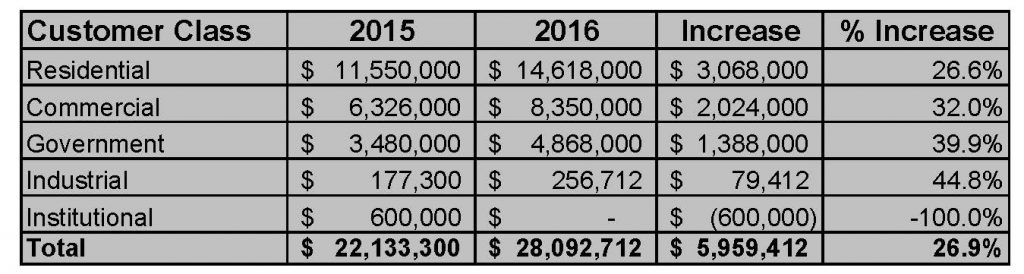

The fire service fee, which is set to increase by 26.9%, will bring in an additional $5.9 million annually, beginning October 1.

Together, these increases will hit residents and businesses with an additional $13.9 million in taxes and fees.

The table below shows each “customer class” with the associated increase. Click on chart to enlarge.

Residential customers will see a 26.6% increase, Commercial customers (small businesses) will see a 32% increase and government affiliated buildings will pay an additional 39.9%.

Just like a bunch of liberals. Raise taxes and spend your tax money on ridiculous programs.

Tallahassee ; rise up and get a clue.

This is just another glaring example of the rampant mismanagement and corruption that permeates Tallahassee City Government. Take this enormous fee increase into account with:

1. The recent property tax increase.

2. The growing evidence that city government for years repeatedly brushed aside all pleas from the police chief for more officers to reduce crime; all the while increasing salaries for other employees and making suspicious expenditures in “crony capitalism” projects (the proposed bar-eatery at Cascades Park).

3. The several recent (and some may be ongoing) investigations of corruption and collusion in Tallahassee government by the FBI and various Florida state agencies.

Plainly, there is an intentional desire for city government officials to advance their own personal and financial agendas over the good of Tallahassee, its citizens, and its future.

For a glimpse at that future, we need only look at how individual American states with corruption, high tax rates, and high crime rates have performed: Businesses and citizens are abandoning poorly-run states like Illinois, California, and New York. Those same businesses and citizens are flocking to well-run, low-tax states like Texas, Florida, North Dakota, and North Carolina.

Just as poor government clearly destroys the future of a state, the same goes for a city.

Tallahassee is slowly forging a reputation as a poor choice to live in Florida. We’re on national news for sleazy football scandals and city crime rates. Meanwhile, in 2011 the city of Gainesville, FL (similar to Tallahassee in many ways) made the cover of Florida Trend Magazine, and in recent years has taken the top city title nationally from both Money and Forbes magazine. In 2010, Gainesville posted a 17.7% increase for high-skill, high pay jobs, the biggest gains of any city in America. Gainesville is in the news also, but for good reasons as opposed to bad.

You may knock Gainesville for your own reasons, but it’s doing something right that Tallahassee clearly is not doing, and that increasingly seems to done in Tallahassee on purpose.

I do not see Tallahassee making the cover of Florida Trend as a business and quality of life magnet any time soon, and never under our present government.

A couple of thoughts for readers to consider: The City ALREADY collects a waste (garbage collection) fee. The bigger issue is that core services (fire, police, EMTs) should be paid first out of existing property tax. Let’s have a debate over the rest of the ridiculous budget. Imagine how much fun we could have listening to Commissioners and staff justify raising taxes for the horticulturist at Cascades Park or the silly “green department”. And yes, if you took the fees and tossed them into the mix by converting to millage, add the proposed tax increase Tallahassee would be far and away the highest taxed city in the state. Steve already did an article. Check the “Exclusives” tab.

I hope that all the money being collected as a “Firemans” fee actually goes toward improving our fireman’s service to the citizens. Next there will be a “policeman’s” fee and a “first responder’s” fee and a garbage collection fee, and I think you get the point. Why not call it a tax? and add it to our property tax? Yes, Leon county is one of the highest taxed counties in the state. It’s time to get control of these fees, it’s out of hand.

Everyone complains but fail support very good alternative candidates.

Steve, with all of these non-property fees being thrown on us, if we were to list them all fees, including waste disposal fees, plus property taxes, how do we compare to other similar size cities in Florida?

I think it was shown in another article that we would possibly have the highest millage rate in the State.