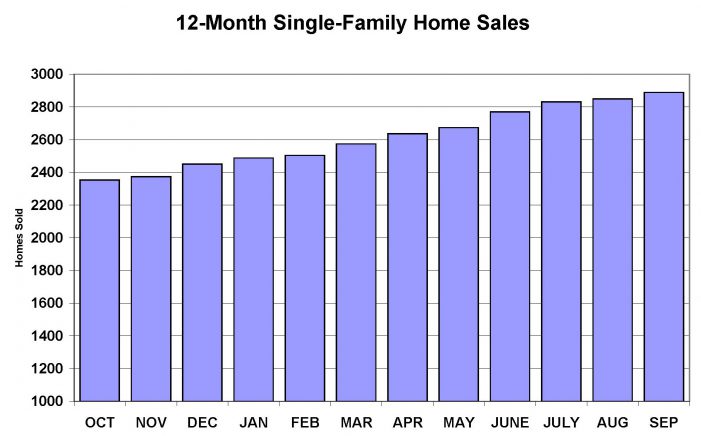

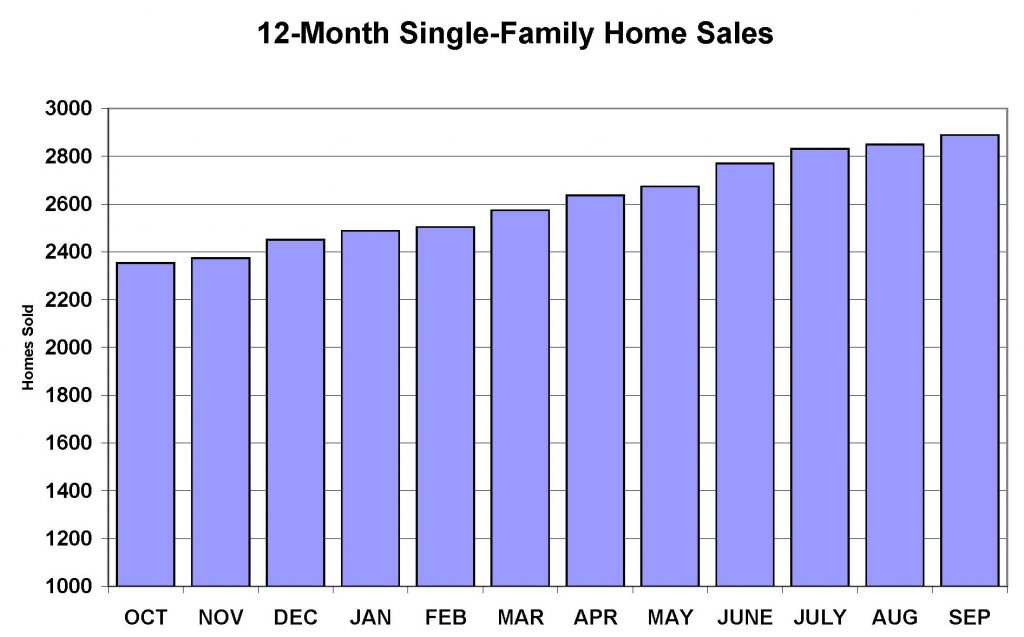

The graph below shows the annualized sales of single-family homes in Leon county over the last 12 months.

The latest information for September shows that the resale market is slowing a bit when compared to the significant increases experienced in the first part of the year.

The current annual rate of single-family home sales, which is 2,889 units, is on pace for a double digit increase over the previous year.

If the current trend continues for the next three months, 2015 will be the third year in a row that single-family home sales has increased by double digits.

Single family home sales increased by 17.8% in 2013, 12.8% in 2014 and are projected to increase by approximately 17% in 2015.

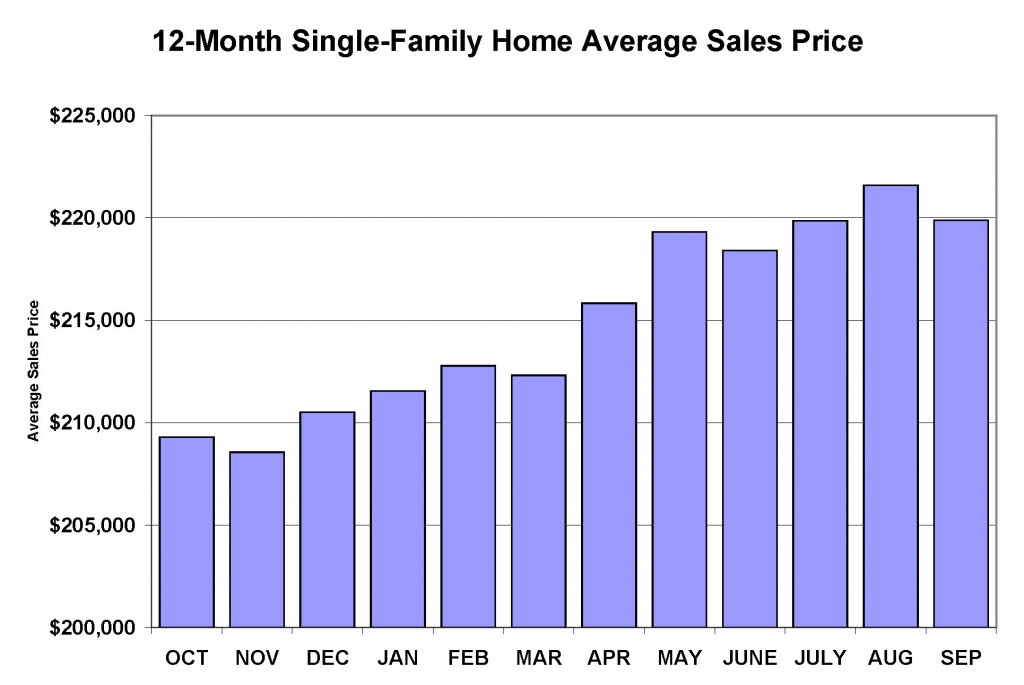

The graph below shows the annualized average sales price of single-family homes in Leon county over the last 12 months.

The last 12 months have seen an approximate 5.0% increase in the average sales price of single-family homes.

This increase comes after a 3% increase in 2014 and a 4% increase in 2013.

The average sales price of a single-family home in 2013 was $201, 000. Based on the most recent three months of information, the average sales price of a single-family home in Leon county is approximately $220,000.

A lot of discussion is occurring in the mortgage lending market on the considerable effect of the new federal TRID loan origination and closing documents and how they will affect mortgage applications and closing.

TRID was meant to have Initial and Closing Disclosure documents that were more borrower friendly, plus they would better understand the true cost of a mortgage initially and through the life of their loan.

Prior to October 1st when the new documents went into effect, there was a considerable number of closings, apparently to beat the new closing disclosure document. Thus, we have seen a drop off in October of applications and closings.

Additionally, origination software vendors are being criticized for not having compliant software effective October 1st. Some companies are, thus, having to complete the new forms manually and slowing the process.

it is estimated that we won’t see a resurgence in the market until Spring, 2016. Time will tell if this holds true.