According to permit filings recorded through November with Leon County and the City of Tallahassee, the number of single-family new construction permits are trending down.

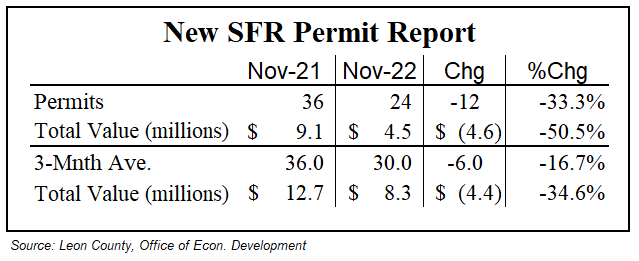

The New SFR Permit Report, provided below, shows the number of November permits is down 33.3% when compared to the number of permits issued one year ago. The value of the November permits are down 50.5%, from $9.1 million in 2021 to $4.5 million in 2022.

A look at the 3-Mnth Ave. data – which smooths out the month to month volatility – shows a 16.7% decline in the number of permits from one year ago. The 3-Mnth Ave. data also shows a 34.6% decline in total permit value, from $12.70 million in 2021 to $8.3 million 2022.

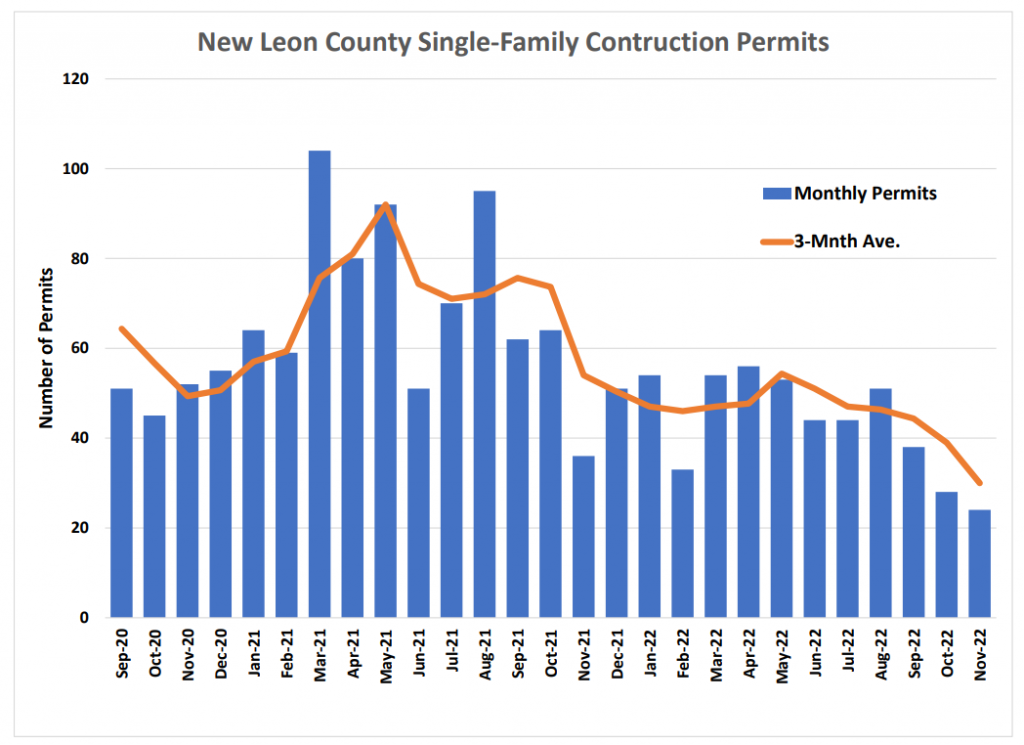

The chart below shows the number of permits issued each month for the last 25-month period. A 3-Mnth Ave. line is also included.

The chart shows that the downward trend in permits began in May, 2021. Since that that time, the 3-Mnth Average number of permits issued has declined 67.4%, from 92 in May, 2021 to 30 in November, 2022.

Since the Feds raised the Rates again yesterday, you can expect the numbers to fall even more soon.

@ A Skeptic: So far, all of the ones contacting me are the ones on the Signs at the Homes that just sold in my area or Realtors that I run into at the Car Events I go to in Tallahassee. I watch my area very close to keep tabs on the Market and so far 95% of the Homes sell in less than two weeks and many for over listed price. I like my area, it’s across from the Appalachee Parkway Regional Park.

@David — I regularly get post cards, flyers, text messages, even phone calls from somebody wanting to “sell my property”. Most of the time it hits the garbage can before I get to the part where it’s a scam. A recent one gave me a good laugh though, when it claimed that it “believed it could sell my 1 acre lot, on Lake Jackson, for $5,500!!!!” Bwahahahaha……

But I have to admit that I enjoy the phone calls. They used to irritate me, until I started taking a different approach to them. Now I see how long I can string them along. If they’re talking to me they’re not scamming anyone else!

I noticed that you didn’t show what the Interest Rate was in 2021 and 2022. I am pretty sure that is why it is dropping.

I am always getting Calls and Visits from Realtors wanting me to sell my Home. It is a nice House on a 1/3 Acre, 3bd, 2Bth, 1 CG, 1000 Heated SqFt. on a small Lake. They tell me now that they can get me $200K for it now which I am sure they can considering what they have been selling for around me. I tell them NO, that my Interest Rate is 2.75% and my Mortgage is $535 a Month and I only owe $72K on it. They just hang up.

I’ve heard the politicians and candidates lament “affordable housing” and “workforce housing” for decades now… especially during election cycles. Politicians and candidates have and continue to exploit the issue knowing full-well they have absolutely no power to do anything about it. The market controls housing and rental properties… toss in increased demand, panic buys, and flippers – and as A Skeptic correctly notes – the Feds (who will absolutely screw up anything it touches), and we have the cyclical mess we have.

The real definition of “affordable housing” is best explained as “whatever house you can afford to live in.” If you want nice things… WORK FOR THEM, and don’t expect the rest of us to pay for them so you “feel” better about your self-determined status in life.

None of this will get significantly better until interest rates come back down.

A $200,000 “starter home” where the buyer has the 20% down ($40,000) and can pay the closing costs (another $5,000+) will have a monthly payment (PITI) over $1,300 at 6.7%. The 3.2% that was available 2 years ago would have a payment of $980 for that same loan. $4,500/year thrown away in additional interest payments.

And most people don’t have nearly $50,000 lying around to buy that house. A down payment of $10,000 adds PMI and finances an additional $30,000 with a monthly payment close to $1,600.

There continues to be more people and less buildable land. Prices will continue to generally go up. Only modest interest rates will put most people in a position to buy.

Regarding the shamefull crash of the housing market, all the associated unemployment, and hardships:

Joe Biden “I did that”.

In addition to the ignored crime crisis by elected officials have you looked at some of the recent horrendous eyesores on the parkway…Boulos, new used car lot on the corner of Apalachee and Capital Circle… does anyone not follow the rules anymore?