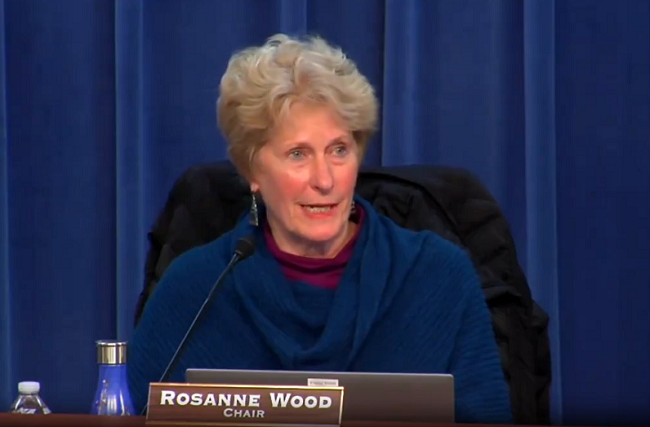

Board member Wood advocates for a $30 million property tax increase.

As budget discussions intensify, Leon County School Board member Rosanne Wood is making a public plea to preserve neighborhood schools, arguing that the typical $1 million in savings gained from a closure is a negligible fraction of the district’s $368 million operating budget.

Instead, Wood is advocating for a $30 million property tax increase.

During a recent Board meeting, Wood responded to statements by fellow Board member Alva Smith, who has consistently highlighted the district’s financial hurdles and the impact of declining enrollment on the capacity of some schools. Smith has argued that closing schools needs to be considered when addressing the current financial difficulties facing the district.

However, Wood characterized the potential savings from closing schools as a mere .002% of the budget, questioning whether “the juice is worth the squeeze” given the immense social disruption involved.

Wood described schools as “beehives” of activity and essential “pillars of a community” where memories and history are made. Closing these facilities, she argued, does more than save money; it “disappears” the magnets that hold neighborhoods together and causes significant transportation and rezoning issues for families.

Instead of shuttering buildings with lower enrollment, Wood lauded a strategy to utilize existing capacity by bringing in external resources, such as early childhood Head Start programs.

One specific example highlighted was Hartsfield, which is currently moving in three such programs. The speaker noted that this approach not only fills facility capacity but also secures a “brighter” future through strategic investment in early childhood development.

The push to keep schools open comes at a time of severe financial strain for the district. Resources are dwindling as funds “go out the door” to private schools and home schooling. While “hard cuts” that will “hurt” are expected, the speaker emphasized that school closures are not an effective solution for these immediate budget shortfalls.

The proposed “game changer” for the district’s fiscal health according to Wood is not a cut, but a request for public support. Wood advocated for a 1-mill property tax increase, which would generate nearly $30 million. This influx of capital would be directed toward critical needs, including improving school safety and boosting teacher salaries.

“The relatively speaking, small amount of money we get for closing a school is not nearly worth the impact that it has on those community neighbors,” Wood concluded. Wood stated she believes the community will respond to the request for a millage increase as they have in the past.

Financial Challenges

Board member Alva Smith’s comments during the meeting addressed schools that are currently operating below 70% capacity. Smith argued that any discussion about the district budget needs to address school closures. Smith noted that savings could be used to increase teacher salaries which ranked 49th among 67 Florida school districts.

The issue of school closures has dominated the Florida public education landscape over the last two years, with many school districts closing schools due to demographic changes and competition from charter schools.

However, public comments by Superintendent Hanna, consistent with the majority of the Board, indicate a lack of support for school closures.

Fewer Students, More Administrators

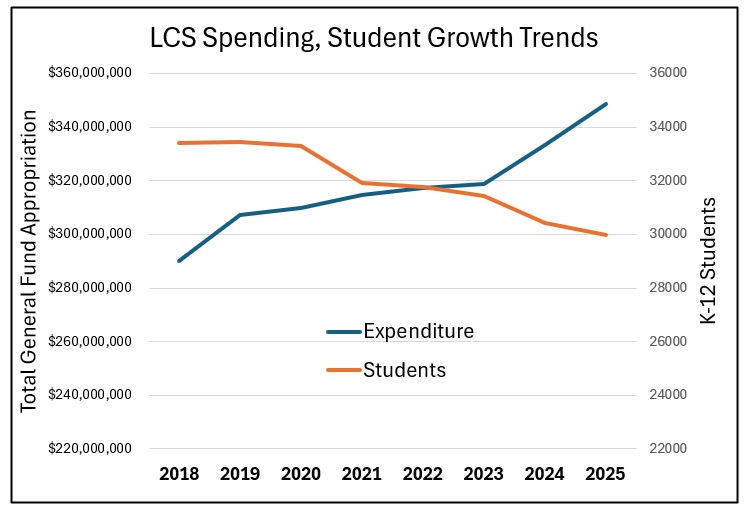

The talk about a property increase comes amid a drop in public school student enrollment and an increase in spending. The chart nearby shows that over the last seven years Leon County School spending has increased approximately $41.7 million, a 14.4% increase, while the number of students has declined from 33,391 to 29,990.

During this time, the number of teachers has dropped from 2,070 to 1772.

In addition, FDOE reports show that the district added 47 School Administrator positions over this period.

From 2018-219 to 2024-25, the number of School Administrators increased by 28%, from 170 to 217 and the “School Administration” budget line item increased from $20.4 million to $25.1 million.

The 47 positions added during this period included 24 Administrator & Managers, 13 Assistant Principals, 6 Deans/Curriculum Coordinators/Registrars and 4 Consultants/ Supervisors of Instruction.

It appears that any tax increase proposal will come after a discussion about current spending priorities and the projected impact of demographic changes on student enrollment.

I’m baffled that the school choice party is speaking out against higher property taxes. This is what was voted for; less student enrollment can only lead to higher taxes, we can’t have it both ways.

My elementary school was bulldozed, replaced, and renamed. My middle school was turned into an elementary school, and later closed. My high school was closed and is currently being used for storage.

Like all illiberals, Wood thinks the solution to every problem is throwing more of other people‘s money at it.

When it comes to fiscal responsibility, she is a real lightweight.

Therefore, The Maven is officially renaming her Rosanne BALSA Wood.

The School Board should be concentrating of Educators & not Administrators. No one pulled their child out of a Public school because there wasn’t enough administrators. Give teachers the resources & pay they need to effectively teach the children. Let the administrators budget diminish through attrition/ retirement.

I am not paying more for a failing school system. Rosanne Wood has lost what is left of her diminished mind, she is doing a disservice to Leon County students. Money is NOT the problem, Rosanne Wood is!

“Always More; Never Enough”